I specifically take pleasure in the interplay involving unique follow places, and have helped shoppers with both equally marital or divorce difficulties and monetary difficulties like...

It relates to the quantity and timing of worth acquired by The patron to the amount and timing of payments designed. FastLoanAdvance simply cannot assurance any APR due to the fact we are not a lender ourselves. Yearly Share Costs (APR) start off from 5.ninety nine% as many as a maximum of 35.99%. Individual financial loans Have got a 91-day bare minimum repayment period as well as a seventy two-month utmost repayment period. Ahead of accepting a loan from a lender inside our community, you should study the personal loan settlement very carefully as the APR and repayment phrases may perhaps vary from exactly what is detailed on this site.

Countrywide Financial debt Aid works tricky to ascertain what economical possibility will operate best for every personal purchaser. A higher BBB score, Qualified team, plus a customer satisfaction assure pushes Nationwide Debt

Look for realistic cars that match your Life style, spending plan and credit history rating. You may have the most luck buying a applied versus new car, but Be careful for maintenance and fix fees, which may jack up the overall expense of proudly owning an auto.

Enrollment will depend on the program's deal renewal. Enrollment within the described program style may very well be restricted to certain times in the calendar read here year Except you qualify for just a Specific Enrollment Time period.

Once you file for Chapter seven bankruptcy, the method normally goes relatively speedily. This type of filing is known as the liquidation bankruptcy, and the whole system is generally carried out within 6 months. After you file, you'll want to state the worth of all of your home, which include your auto.

Home fairness financial loans Home equity important site financial loans Enable you to borrow a lump sum at a fixed amount, according to how much of the home you possess outright.

Listed here’s what you have to know about bankruptcy car financial loans and how to get back again over the street immediately.

Whilst check this it's very good to acquire the choice to declare bankruptcy, it's not difficult to see why it should usually be the final choice. Declaring bankruptcy is really a drastic motion to just take, click reference and may impact your daily life For a long time to come back.

Despite your steps, expect a ready period prior to deciding to can qualify for your car or truck financial loan with bankruptcy. You might require to current a duplicate of the bankruptcy discharge purchase to lenders, and it's going to take about sixty days to acquire the purchase after your court docket proceedings. helpful resources Industry experts endorse waiting a year after bankruptcy before acquiring An additional bank loan, if possible.

Your lender or perhaps the dealership finance manager will walk you in the auto bank loan documentation checklist, like any prospective seller charges. Study the good print and ensure you comprehend the personal loan phrases ahead of continuing.

The Preliminary session is complimentary. Although this is one of our favorite sources for trusted personal debt consolidation, there are a few states whose people won't be qualified for CuraDebt's products and services.

However the bankruptcy filings carry on to forestall endeavours to receive damages, with one family members trying to gather assets from Jones’ enterprise in a method that other households argue could go away them with close to absolutely nothing.

You may be compelled to offer your car or return it on your lender should you personal sizeable equity in it.

Luke Perry Then & Now!

Luke Perry Then & Now! Dylan and Cole Sprouse Then & Now!

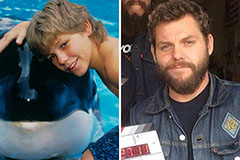

Dylan and Cole Sprouse Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now!